Blockbuster Video: How not to run your business

By Aniket Gupta | 14 Dec 2023

Long before movie streaming was a normal day routine for us, there used to be video stores that used to rent out VHS tapes and DVDs. If you were born after the year 2000, then maybe you wouldn’t even know about, or remember, this iconic business that used to stand tall, renting out movies to people and making their lives happier. The business I am talking about is Blockbuster Video.

Founded as a stand-alone mom-and-pop home video rental shop, Blockbuster Video grew to become a company valued at $3 billion at its peak in the mid-2000s. Unfortunately, today, it is just another name in the history books that could not catch up with the future. But how did a company so big cease to exist? This article will tell you exactly that.

Birth of Blockbuster Video

Blockbuster Video was founded by David Cook in 1985. He got this amazing idea of starting his video rental store when he was helping his friend do a study about video stores. He realized that, if managed properly, a video store could potentially turn into a multi-million dollar business.

Back in the 1980s in the US, the idea of a video rental store was not new, although it was uncommon. The first professionally managed video store in the US was Video Station. This store was opened by George Atkinson in 1977 in Los Angeles. Video Station housed some popular movie VHS tapes such as Butch Cassidy and the Sundance Kid, M*A*S*H, The King and I, and The Sound of Music.

David Cook had a similar idea, but he didn’t just want to rent out movies. He wanted to create an overall experience that compelled customers to visit his store again and again.

So on 19th October 1985, he started the very first Blockbuster Video Store in Dallas, Texas, with the hope of turning it into a large business. And he did. In the next ten years, Blockbuster Video grew rapidly, and by the late 1990s, Blockbuster owned over 9,000 video rental stores in the US.

During the 1990s, Blockbuster also entered the international market. It had a presence in Australia, Brazil, Canada, Denmark, Germany, Hong Kong, Ireland, Israel, Japan, Mexico, New Zealand, Norway, Peru, and the United Kingdom, among others. It was safe to say that Cook’s dream about turning a simple mon-and-pop video store into a huge store chain had come true.

But as history has often shown, the higher they climb, the harder they fall. Something similar happened to Blockbuster Video. When it was busy riding the highs of its success, other competitors were busy innovating their business models to compete with David Cook.

But before we learn about the fall of Blockbuster Video, we need to take a deep dive into its business model. The company used a unique model to rent out movies to its customers as well as to ensure good customer experience and customer retention.

Blockbuster Video’s business model

The most vital source of revenue for Blockbuster Video was renting out VHS tapes and, later, DVDs. But how did Blockbuster procure these VHS tapes from the film studios in the first place?

It was quite simple.

Blockbuster used to buy a bunch of VHS tapes directly from the studios through a licensing deal. Then it used to rent them to people until it recovered its cost. And once the rent period was over, Blockbuster would sell the tapes to other customers. As Blockbuster used to buy in bulk from the movie studios, it used to get good discounts; in some cases, Blockbuster Video would even work out revenue-sharing deals with the studios.

Blockbuster had a simple strategy that involved customers renting movies in bulk on a single outing for a limited period of time. If a customer failed to return the tapes after the allotted time, they had to pay a late fee to Blockbuster Video. This approach was the most substantial source of revenue for Blockbuster Video.

As you can see in image 1, Blockbuster Video earned 76.7% of its revenue from rentals in the year 2003. It earned 21.7% of its total revenue from merchandise sales and 1.6% from other sources such as third-party advertising, etc.

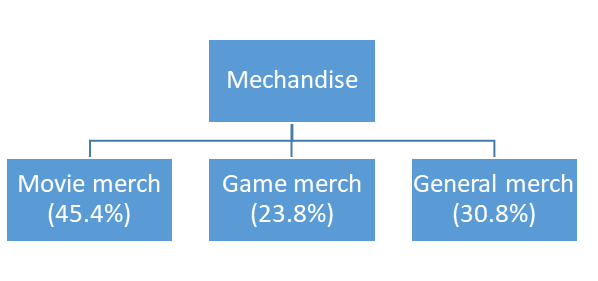

In merchandise sales, the store would sell different kinds of merchandise from popular movies and video games. For example, a T-shirt from a popular movie or a cap with the logo of a popular video game.

Although this revenue was not a big chunk of Blockbuster’s total revenues, it still helped the company maintain steady sales. Movie merchandise comprised 45.4% of total merchandise sold in 2003. Similarly, game merchandise comprised 23.8% and other general merchandise comprised 30.8% of total merchandise sales in 2003 (see image 2).

Another unique business practice that distinguished Blockbuster from its competitors was its extensive selection of titles. Unlike other independent video stores that could only manage around a hundred movies, Blockbuster used an innovative barcode system that allowed the company to monitor up to 10,000 VHS tapes per store for each registered customer, enabling it to also keep a close watch on those profitable late fees.

Early signs of trouble

However, in the mid-2000s, the landscape of the video rental business started to change. One of the biggest reasons for this was Netflix.

.jpg)

While people today know Netflix as the over-the-top (OTT) streaming giant that launches various popular shows and movies every year, it wasn’t always like this.

On 29th August 1997, Reed Hastings and Marc Randolph launched Netflix. During its launch, Netflix acted as a DVD-by-mail rental service. It used to send movie DVDs to its customers via mail rather than having a store where customers would visit to buy DVDs. So that meant Netflix was doing the exact opposite of what Blockbuster Video did. With Netflix, the movie DVDs came to you, whereas with Blockbuster, you had to go to the movie DVDs.

Ironically, how Netflix started was this: one of its founders, Reed Hastings, was irked by a late fee of $40 from Blockbuster Video. That late fee cost was higher than the rental cost of the movie itself. A furious Hastings decided to create a business that did not have any late fees at all.

Netflix also used a subscription-based method and launched a website, Netflix.com. Customers could go directly to the website and purchase a monthly subscription to Netflix. This would enable them to rent unlimited movies for free. They just had to add their desired movies to their carts and place their order. Within three to four business days, Netflix would send some of the movies to the customers in a sealed envelope. Once the customer was done watching them, they could put them back in that envelope and post them back to Netflix. In response, Netflix would send a few more movies from the customer’s cart.

This system would create a continuous cycle of demand and supply between Netflix and its customers, and hence it would not have any late fees.

During the initial years, Netflix kept this subscription cost at $20 a month. So for just $20 a month, customers could enjoy unlimited movies with no late fees. This cost was substantially less than renting a single DVD from Blockbuster Video. The result: customers started to shift from Blockbuster Video to Netflix.

Missed opportunities

Blockbuster Video had an opportunity to buy Netflix in the year 2000 for $50 million. Unfortunately for Blockbuster, it decided to move in a different direction and hence passed up this opportunity.

Instead of buying Netflix, in July 2000, Enron (yes, Enron, the big scandal name) and Blockbuster Video signed a 20-year agreement to introduce on-demand entertainment to various American cities by year’s end. But the deal was doomed from the start. It became clear that Blockbuster Video still wanted to focus more on its stores than on the online platform. This resulted in Enron doing most of the work.

On 2nd December 2001, Enron filed for bankruptcy, and Blockbuster had to walk away from the deal.

Blockbuster Video tried different things to grow its business and compete with the likes of Netflix. In 2004, Blockbuster offered a subscription service called Blockbuster Movie Pass. Blockbuster even cancelled the late fees in early 2005 to gain more customers. But it was too late. Netflix had already captured that market.

In late 2006, Blockbuster introduced Blockbuster Total Access, a new online subscription service. This service enabled customers to borrow multiple movies simultaneously, either through mail delivery, similar to Netflix, or by exchanging them at their nearby Blockbuster store.

Blockbuster even launched Blockbuster Express, which was a DVD rental kiosk, but it was already an outdated technology as the digital age had already started, thanks to Netflix.

The fall of Blockbuster Video

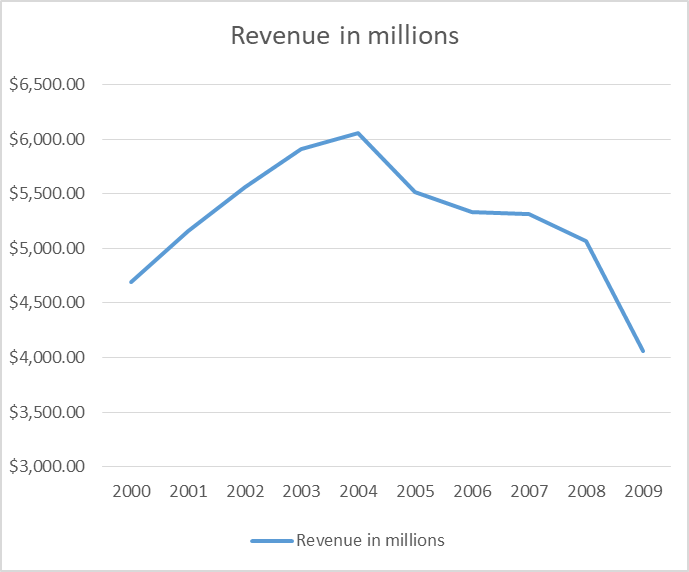

From 2001 to 2010, Blockbuster saw a huge decline in its revenue. Every business practice that it tried was already conquered by some other company.

As you can see from image 3, there was a rise in revenue from 2000 to 2004, but then came a sharp decline starting in 2004. This decline was due to the growing popularity of Netflix and other video rental businesses that had embraced the digital age.

As a consequence of the decline in revenue, Blockbuster Video had to close down stores across the U.S. In image 4 (see below), you will notice that since 2001, the number of Blockbuster Video stores witnessed a gradual decline. The fall in revenue (as seen in image 3) forced Blockbuster Video to close its stores across the United States.

Blockbuster Video went from having around 9,000 stores in the U.S. in 2001 to around 2,500 stores in 2010. Furthermore, there was a sharp decline in the total number of Blockbuster Video stores from 2004 to 2006. This was due to Netflix gaining momentum, eating into Blockbuster Video's business, and attracting its customers.

You would also see that there was a sudden growth in the number of Blockbuster stores from 2006 to 2008. This was due to the launch of Blockbuster Total Access at the end of 2006. Blockbuster had opened new stores to make it easier for customers to return the DVDs they had rented through the mail. But it was not a long-term approach, as the number of stores Blockbuster operated saw a sharp drop in 2010.

The 2000s decade was a very bad time for Blockbuster Video. It went from having more than 9,000 stores at the turn of the 21st century to having just one video store in Bend, Oregon, USA, in 2018. This last store was famously known as the Last Blockbuster, and in 2020, it became the world’s last store carrying the Blockbuster brand.

.jpg)

Blockbuster Video hit a new low when it was delisted by the New York Stock Exchange on 1st July 2010. Reports had started to come out in mid-2010 that Blockbuster Video was planning to file a pre-packaged Chapter 11 bankruptcy in mid-September of 2010. Following these rumors, Tom Casey, chief financial officer of Blockbuster Video, resigned from his position on 11th September 2010.

Finally, on 23rd September 2010, Blockbuster Video filed for Chapter 11 bankruptcy protection. Given its huge losses and a debt burden of over $900 million (~$1.19 billion in 2022), it just could not compete against Netflix, Redbox, etc.

This was the time when Carl Icahn, one of the biggest shareholders of Blockbuster Video, famously stated that Blockbuster Video was the “worst investment I ever made.”

Later in February 2011, it was reported that Blockbuster might not file for Chapter 11 bankruptcy as it did not meet the financial obligations to do so; instead, it would have to file for Chapter 7, which meant complete dissolution of the company. To avoid this, Blockbuster executives decided to sell the company for $300 million (~$387 million in 2022) or more.

This decision started a cycle of further decline for Blockbuster until only one Blockbuster store remained in 2018.

Where did Blockbuster go wrong?

The fall of Blockbuster can be divided into four points.

- Could not capitalize on the first mover’s advantage: When Blockbuster Video came into existence, it used a business model that was already in use but not very common. It had a kind of first-mover advantage, and with the help of its unique barcode system, which helped to keep track of multiple customers and pending books, it could significantly grow its business. But that was about it. Blockbuster never thought of innovating its business model to stay ahead of the curve, something Netflix succeeded in doing in the early 2000s.

- Bad business deals: Throughout the 21st century, Blockbuster Video has had several chances to restructure its business. But it never did. It had an opportunity to buy Netflix, but that did not happen. Instead, Blockbuster signed a deal with an already doomed company like Enron. After 2010, multiple companies tried to run Blockbuster Video. On 6th April 2011, Dish Network bought Blockbuster Video for $320 million and assumed $87 million in liabilities and other obligations. Even Dish Network could not revive Blockbuster Video.

- Outdated business models: Since the early 2000s, Blockbuster was just playing catch up to its competitors; its original business model had become outdated, and it could never properly integrate its business model with the digital age. For example, it was too late to launch its subscription model, and the DVD rental kiosk launched by Blockbuster was already a technology that had become obsolete.

- Poor leadership: Blockbuster’s fall was also credited to poor leadership. One of the Blockbuster franchise owners, Ken Tisher, stated in 2015 that the Blockbuster story would be going to Harvard Business Review for readers to learn how not to run a business. A former marketing communications executive at Blockbuster Video, Jonathan Salem Baskin, stated that the digital age did affect the business of Blockbuster, but it was not the killer. That title belongs to the upper management of the company. He emphasized that if the top management of Blockbuster had changed their approach over time, maybe Blockbuster would still exist.

Business lessons

There are three very important lessons one can learn from the failure of Blockbuster.

- You don’t need to have the most unique business idea or business model. You just need to have the determination to accept change with time.

- Customer service is very important. Blockbuster started with an excellent customer service record, but with time, its service started to deteriorate. It also had bloated late fees, which most customers did not like paying; by the time Blockbuster rectified this, it was too late.

- You need to have a very strong and stable leadership team in any business. Fickle-minded people would never be able to run a business successfully. Blockbuster regularly changed its top-level management, and this decision impacted its operations heavily.

The story of Blockbuster Video might be unknown to many, but it is a very important chapter of business history. Blockbuster Video was successful during the 1990s, but with time, it just became another name on the long list of companies that failed.