Company story – Quaker Oats

By Kiron Kasbekar | 08 Mar 2024

Quaker Oats is a company whose products I remember from my childhood days. Years before a foreign exchange crisis caused the Indian government to impose curbs on consumer product imports, we used to see a host of foreign brands in the Indian market. Including Quaker Oats, which I remember eating when I was a child, and which has been available for the past two decades or more.

The Quaker Oats I remember from the past used to be made and sold by an independent company. The products are now part of the PepsiCo basket of companies and are still enormously popular.

That popularity might have got a bit shaken as reports appeared in the American press in 2024 about the harmful effects of some Quaker Oats products.

One of these is an article published by Time magazine on 16th December 2023 and updated on 12th January 2024. It says, ‘The Quaker Oats Company has expanded its list of recalled items to include additional cereals, bars, and snacks that pose a risk of contamination with Salmonella, the Food and Drug Administration announced on Jan. 11.’

The company admitted that there was contamination of Quaker Granola Bars, Quaker Cereal, Cap’n Crunch Treat Bars, Cereal, Instant Oatmeals, Gamesa Marias Cereal, Gatorade Protein Peanut Butter Chocolate Bars, Munchies Mix Munch Mix, and Snack Boxes. And it announced a recall of these products.

At the same time, it said the recall did not include Quaker Oats, Quaker Instant Oats, Quaker Grits, Quaker Oat Bran, Quaker Oat Flour, and Quaker Rice Snacks.

There were other times when Quaker Oats was lambasted for selling products that affected the health of consumers. But these seem to have been mere blips on the screen so far.

The beginning

Unlike in Europe, where people were accustomed to eating oats, Americans thought of oats only as animal feed. So, for example, stables would keep stores of oats for the horses tethered there. Oats were also used as poultry feed.

It was only in the second half of the 19th century that Americans began to look upon oats as food for humans.

It was only then that oat milling and packing firms cropped up in eastern United States and Canada. These firms went through acquisitions and mergers (see box), and eventually the Quaker Oats Company emerged from that process of consolidation in 1901.

Early days

| Year | Event |

| 1850s | Ferdinand Schumacher founded the German Mills American Oatmeal Company in Akron, Ohio, and Robert Stuart founded the North Star Mills in Hearst, Ontario, Rupert’s Land. |

| 1877 | On 4th September, Henry Seymour founded the Quaker Mill Company of Ravenna, Ohio, and applied for the first trademark for a breakfast cereal — a figure of a man in ‘Quaker garb’. |

| 1879 | Robert Stuart and his father John created Imperial Mill in Chicago, Illinois, jointly with George Douglas |

| 1881 | As oat milling became popular, several of the mills could not compete, and folded up. Henry Parsons Crowell bought one such bankrupt firm, the Quaker Mill Company, and held the key positions of its chairman, general manager and president from 1888 until late 1943. He became known as the cereal tycoon. |

| 1901 | The Quaker Oats Company was founded in New Jersey by the merger of four oat mills:

In the same year, the whole merged company was acquired by Crowell, who also acquired the bankrupt Quaker Oat Mill Company, also in Ravenna. The company made Chicago its headquarters. |

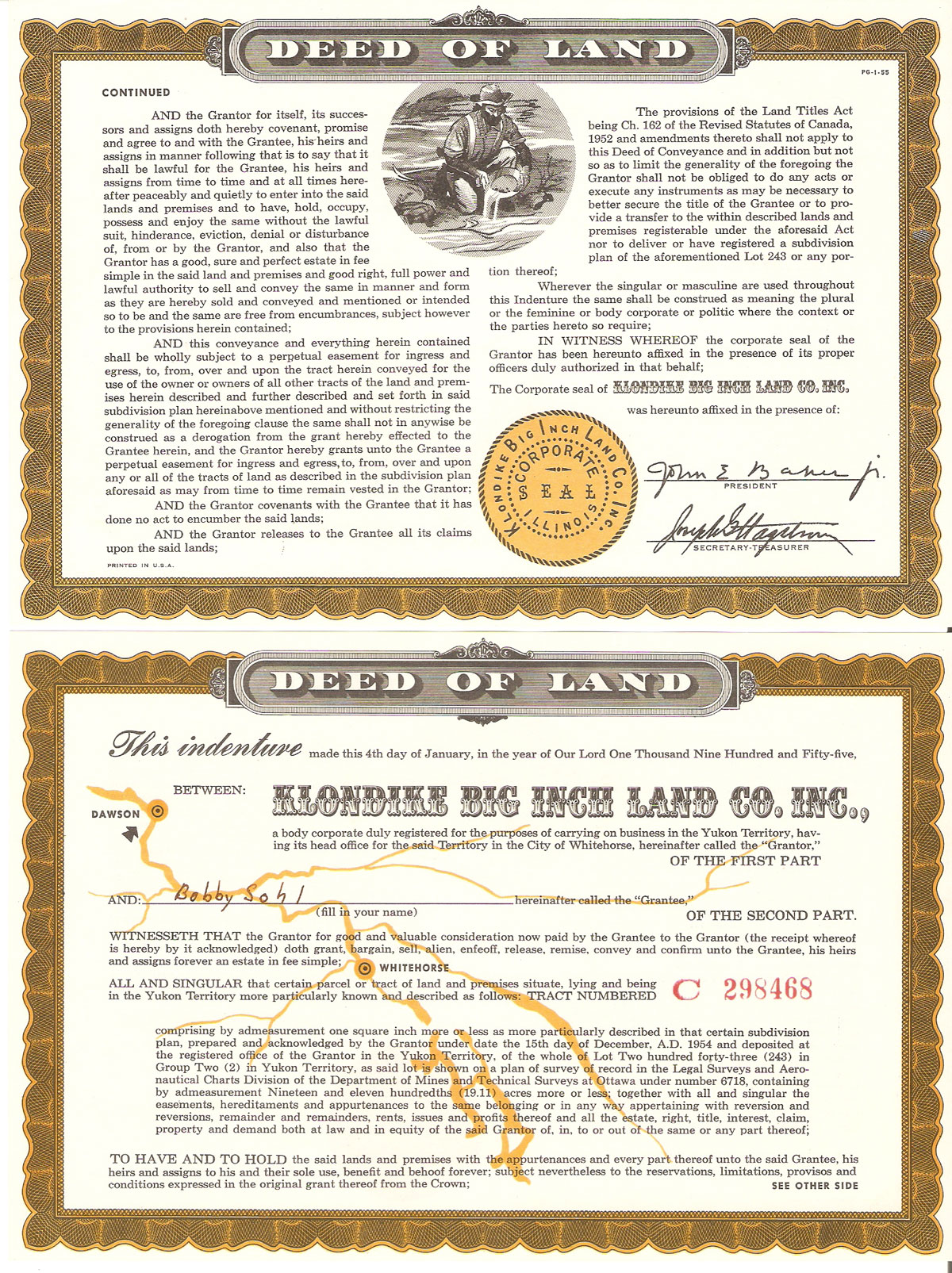

In 1902 the company launched a marketing campaign through its advertising, in which it promised small tracts of land to Quaker Oats customers who found coupons inside their oatmeal boxes, which they could exchange for land deeds. How big were the properties? Just 1 foot x 1 foot! Meaning, one square foot – the size of a mid-size tile!

Buyers of Quaker Puffed Wheat, Quaker Puffed Rice and Muffets Shredded Wheat were offered deeds to one square inch of land near Dawson City, a mining hub town during the Klondike Gold Rush of the late 1890s. It’s in the back of beyond in the icebound Yukon Territory of Canada, which even today has an overall population density of just 0.8 persons per sq.km – or 4 people every 5 km! How many people would like to go and settle in a place like that?

Laughable as the idea was, it did attract many children to Quaker Oats’ oat boxes. If such a scheme were to be announced today, it would have been condemned as a scam!

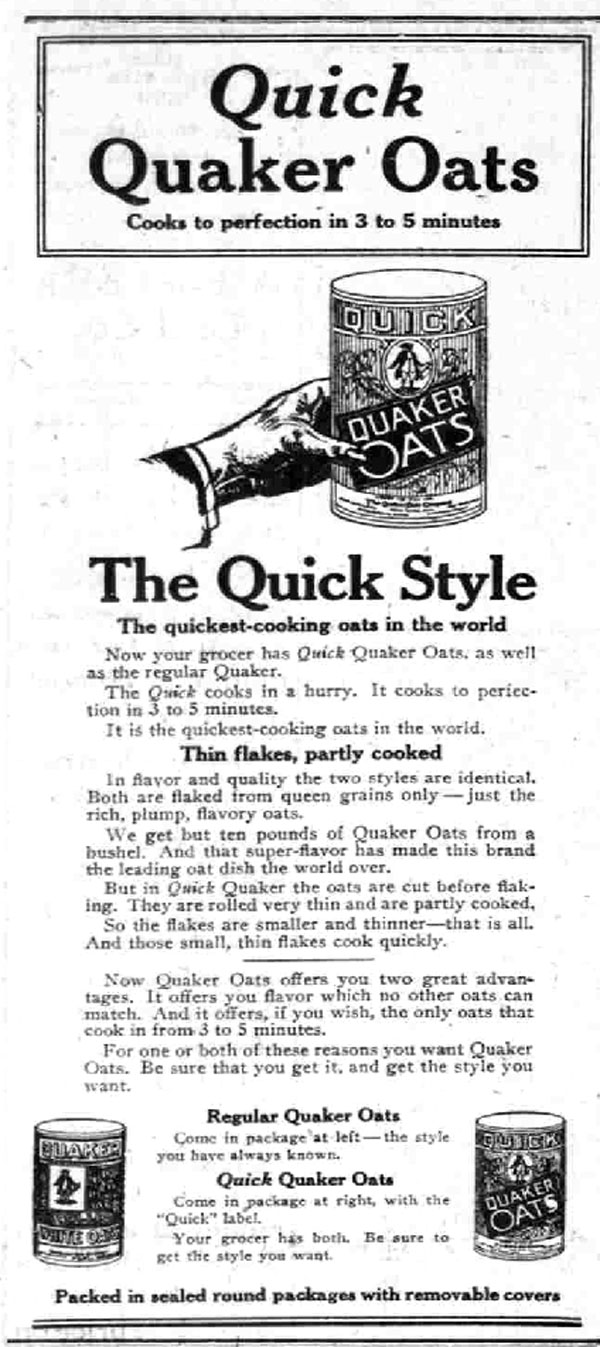

One-hundred years ago, the company introduced the now-iconic cylindrical Quaker Oats package. The packaging design has been updated since then, but the round canister can still be found in shops.

The man who launched the canister design was Henry Parsons Crowell. In 1915 food cans were a new trend, and, having noticed the public’s attraction to colorful and convenient-sized packaging, Crowell decided to sell Quaker Oats in their own distinctive round cardboard cartons.

In 1911 Quaker Oats acquired Mother’s Oats, consolidating its position as a dominant player in the American milling industry, especially east of the Rocky Mountains.

In 1915, Quaker Oats unveiled the iconic cylindrical packaging that soon became a widely recognized box on shop shelves, further consolidating its position in the market. Then, in 1922, the company introduced Quaker Quick Oats, one of the earliest convenience cereal products. It was a time when consumers were fast and convenient breakfast options, and Quaker scored a big hit.

With growing urbanization, the popularity of quick-fix meals grew, and so did Quaker Oats’ sales graph – but not without regular innovations and new product launches. The company launched Life Cereal in 1961, Quaker Instant Oatmeal in 1966. Then it launched Maple & Brown Sugar variants.

In 1981 the company launched Quaker Chewy, its chewy granola bars. Granola bars were not new. They were made and sold under various names by several companies, big and small.

Acquisitions and sell-offs

So much has been said here about Quaker Oats’ oats- and other food-based products, you might think that’s all the company did. Oh no! It did many other things, some successfully, others not so. And if you see its total businesses, you’d understand that a good part came from acquisitions.

Among the first was Fisher-Price, the toy company, which it acquired in 1965 and ran until 1995 because by then it had decided to focus on the grocery market. In 1968 Quaker Oats acquired Celeste Pizza as part of the expansion of its frozen food offerings. The business was later spun off in 1996.

In 1972 Quaker Oats acquired toy maker Louis Marx and Company, but realized soon that it was not able to run it profitably, and sold it in 1976.

Then, in 1982, the company acquired US Games Corporation, and that turned out to be a blunder. US Games was shut down by 1983. This was a case of a successful company blundering into an area it was not familiar with. US Games was a video game company that produced handheld electronic sports games. Quaker Oats hoped it could use this acquisition to develop games for the Atari 2600, and the company actually released its first game for the Atari, Space Jockey, in January 1982, followed 13 others under the brand name Vidtec.

What was Quaker Oats doing? It wanted to combine US Games’ products with those of Fisher-Price toys to compete with rival cereal company General Mills’ Parker Brothers division. Unfortunately for Quaker Oats, while Parker Brothers succeeded in video games, with hits such as Frogger and The Empire Strikes Back; the US Games’ venture bombed. The Quaker management wisely decided to shut down the operation rather than pour more money into it.

In 1982 Quaker Oats acquired Ardmore Farms, adding orange juice production to its portfolio, but eventually sold it to Country Pure Foods in 1998, saying it was not part of its core business.

In 1983 the company acquired Stokely-Van Camp, which brought brands like Van Camp’s and Gatorade into the Quaker product portfolio. Gatorade was the key brand in this acquisition.

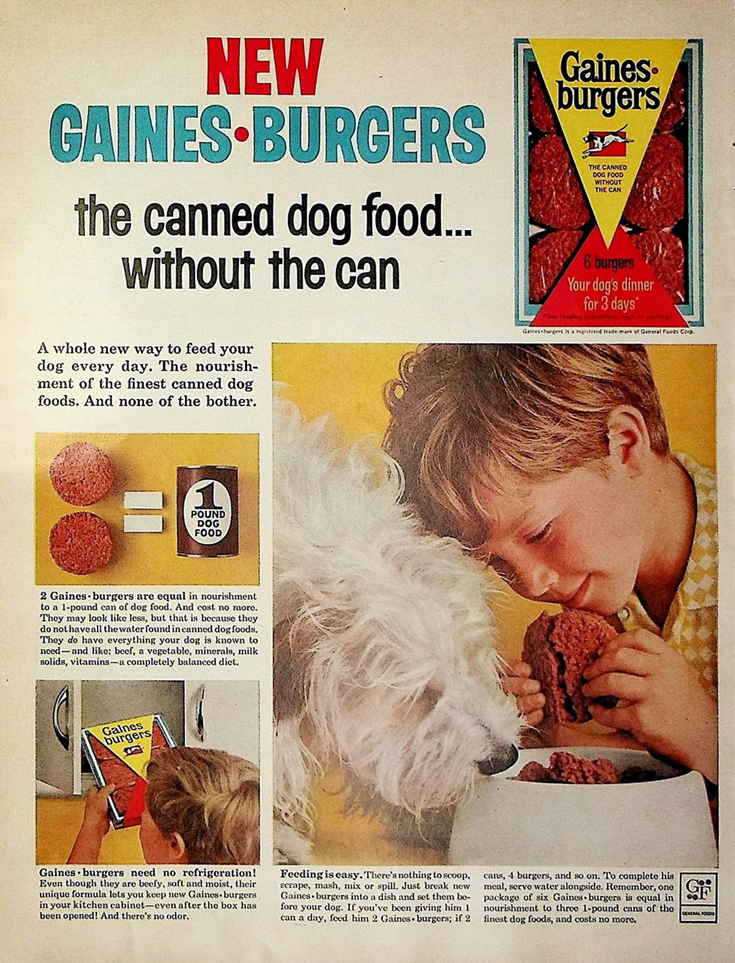

In 1985 Quaker Oats acquired Anderson, Clayton & Co., to grab the latter’s Gaines Pet Foods operations. Anderson, Clayton had been launched in 1904 as a cotton trading firm, became the world's biggest cotton trading company riding on high demand for cotton during the First World War, then diversified into cotton gins and cotton oil mills in several countries, and began to diversify further, entering pet foods and salad dressings in several countries, including Mexico and Brazil. Then it got hit by currency devaluations in those countries, because of which its finances took a hit. An insurance company it had acquired ran into losses, had to be sold off, as was a warehouse and trucking company it had acquired.

In 1986 Quaker Oats bought the Golden Grain Macaroni Company and expanded its share of the pasta market.

In 1994 Quaker Oats spent a whopping $1.7 billion to acquire Snapple, an iced tea and fruit juice brand, and in just three years, sold it to a company called Triarc, which had moved out of the cigar business and then out of cigarettes, and was looking desperately for businesses to get into.

So desperate was Quaker Oats to get rid of Snapple that Triarc was able to snap it up for just $300 million. That was 27 months after Quaker had purchased it at nearly six times that price and then spent more money promoting it. In the year 2000 Triarc disposed of Snapple for $1.45 billion!

In 1996 Quaker Oats sold its frozen food business.

In 2001, Quaker Oats was acquired by PepsiCo.

Sad end?

What we see in the latter half of Quaker Oats’ history is a series of attempts at diversification, in and outside the foods industry, most of which failed to bring cheer to the company. Fortunately, its 1983 acquisition of Stokely-Van Camp was a big success as Gatorade became a key driver of growth and financial performance, which soon lured PepsiCo into acquiring Quaker Oats. The 2001 acquisition of the company by PepsiCo, a hundred years after its incorporation, was a sad end for the company, in a sense, but the business has survived, under PepsiCo. Now we hear of noises that Pepsi might be willing to unload Quaker Oats.

While Quaker Oats is reasonably profitable considering its $452-million operating profit on $2.2 billion in net revenue for the 36 weeks ended 9th September 2023, it may not be enough for Pepsi.

Of Pepsi’s seven divisions, the biggest revenue earning divisions are these three: PepsiCo Beverages North America, Frito-Lay North America, and Europe. The Quaker Oats division is reportedly the slowest growing among Pepsi’s main divisions.

Considering the low growth rate of the Quaker Oats division compared to some other divisions, there is talk that Ramon Laguarta, who succeeded Indra Nooyi as Pepsi chairman and CEO, will be more willing than she was to do some chopping at Quaker Oats. Don’t be surprised if you head something along these lines sometime this year.