Charles Ponzi: The architect of fraud

By Aniket Gupta | 07 Feb 2024

Have you ever heard of a Ponzi scheme? If you have read my article on the Ponzi scheme in domain-b.com, then I am sure you know what it is. The fraudulent scheme was devised by a man named Charles Ponzi.

So who was Charles Ponzi? An Italian immigrant who scammed some 30,000 people in the US and Canada to make millions of dollars for himself.

Origins of the Italian swindler

Charles Ponzi was born on 3rd March 1882 in Lugo, a small town in northern Italy. His grandparents and great-grandparents were well-to-do, but the family later fell on hard times. By the time Ponzi came along, there wasn’t much money left in the family. His father was a postman who used to work hard to keep the family financially comfortable.

Ponzi was not born with a silver spoon, but he did crave the taste of riches nevertheless. From his childhood, Ponzi felt cheated, for he was poor while his ancestors had been swimming in money.

The four-year vacation

Ponzi’s mother always dreamt of sending Ponzi to college, and so he was sent to college. Charles Ponzi, in his own words, describes this period as a ‘four-year vacation’.

After his father passed away, Ponzi inherited a modest sum of money. Ponzi then enrolled himself in the Sapienza University of Rome, not with the intention to study but to party with rich friends.

Ponzi hung out with his friends in the local bars, cafes, and operas. This resulted in him burning through all his inheritance. As Ponzi was busy partying with his friends, he did not study at all during his time at the university. This left him broke and without a degree after four years.

In the early 20th century, many young Italian men started to migrate to America in search of better opportunities. Ponzi too decided to try his luck in the ‘land of opportunities’.

Ponzi reaches America

The date was 15th November 1903, as the S.S. Vancouver made port in Boston, USA. Among the many passengers deboarding the ship, a young Ponzi with high ambitions stepped foot in America.

Upon entering America, Ponzi soon realized that dreams and ambitions were worth nothing in this land if you were not willing to work hard. But he had other ideas. He wanted to earn a lot of money in as little time as possible. There was also a bit of guilt in his mind about shattering his mother’s dream.

In his initial years in America, Ponzi did a lot of odd jobs along the east coast of the country. So it might have seemed that Ponzi was trying to make an honest living; but the reality was quite different. Ponzi repeatedly got fired from his jobs because of accusations of theft, his lazy attitude, and his constant attempts to cheat customers.

Finally, in 1907, Ponzi decided to shift to Montreal, Canada, hoping that his fortunes would change there. He did manage to land a job as an assistant teller in a bank named Banco Zarossi, started by Luigi “Louis” Zarossi. This bank primarily provided service to the Italian immigrants entering the city.

Robbing Peter to pay Paul

Zarossi used a clever but illegal method to provide 6% interest on bank deposits. This was double the standard rate at that time. Rather than paying the interest rates from profits, Zarossi used to pay the rates from the money deposited in the newly opened accounts.

That scheme stuck in Ponzi’s mind. And he mulled it over even as he rose to the rank of bank manager with his confidence and charming personality.

Soon, Zarossi’s fraud was unveiled, and he fled to Mexico with the remaining money. Ponzi stayed back and got caught by the police when he tried to encash a cheque with a fake signature. He had to spend three years in a Canadian jail, from 1908 to 1911.

After his release from prison in 1911, Ponzi decided to return to America.

After years of traveling around looking for jobs, Ponzi finally settled in Boston. In 1918, he married Rose Maria Gnecco, a stenographer. And he continued doing different jobs until he decided to go big and start something of his own.

Promising the sky, delivering the fraud

Although Ponzi had grand ambitions, his goal was simple: to earn a lot of money so he could provide a luxurious life for himself, his wife, and his mother in Italy.

In 1919, Ponzi decided to start a trade magazine where companies would pay him fees to publish their advertisements. He called his magazine Trade Guide and wrote to several hundred companies, hoping that they would line up with money in their hands. Ponzi was so certain of success that he had also set up a small office at 27 School Street in Boston.

But reality soon hit Ponzi, as not a single company showed any interest in his magazine. When all hope seemed to be lost, he received a letter from Spain, which would change his life completely.

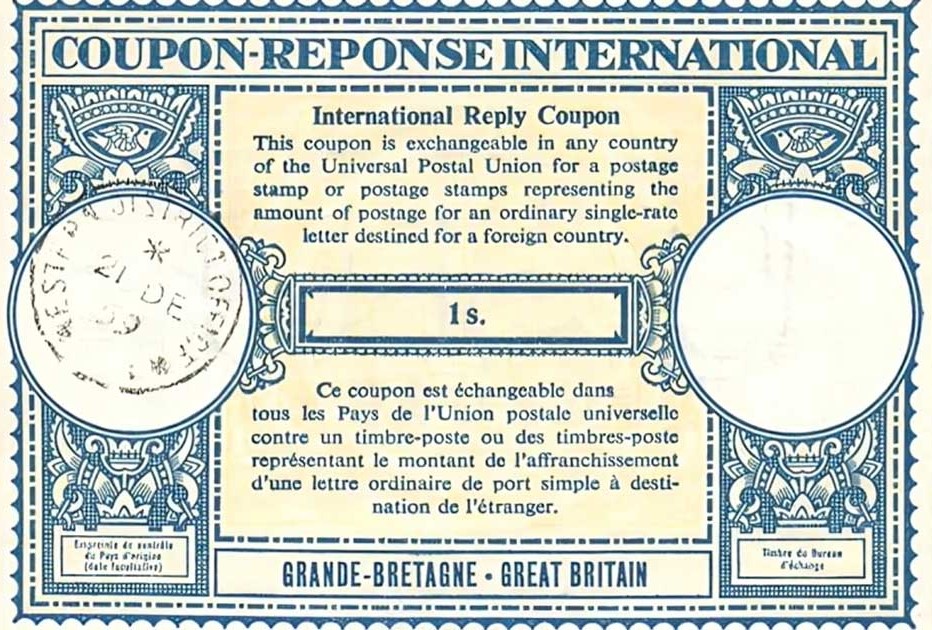

The letter had come from a Spanish company enquiring about the Trade Guide. When Ponzi was writing to companies, he had written to several companies in Europe – and, after writing to several companies, only one of them showed interest in his magazine. Now, the key! In the letter from the Spanish company, Ponzi found an international reply coupon (IRC). That IRC was to become the goose that laid golden eggs for Ponzi.

What is an IRC?

An international reply coupon, or simply an IRC, made it easy for people in one country to cover the postage for a reply to someone in another country. IRCs were sold at the postage cost in the buyer’s country but could be swapped for stamps to handle the postage in the recipient’s country. Ponzi realized that if the values were different, there was a chance to make a decent arbitrage profit.

.jpg)

Years earlier, when Ponzi was working at Banco Zarossi, he had learned about arbitrage, which means making a profit from the different rates for an asset in different markets. Ponzi decided to apply this principle to IRCs.

After World War I ended in 1918, the lira, the currency of Italy, had taken a serious hit. So Ponzi devised the idea that he could buy IRCs in Italy and then sell them in America, where the value of the dollar was higher. Now remember that arbitrage is completely legal and was practiced for centuries. So Ponzi had nothing to worry about – except for one thing: funds.

Ponzi needed a huge amount of investment to start his new scheme. To facilitate the funding for his new scheme, Ponzi decided to set up his own joint stock company.

In January 1920, Ponzi started his company, the Securities Exchange Company (not to be confused with the Securities and Exchange Commission).

When Ponzi thought that he was finally going to be rich beyond imagination, reality came crashing down on him once again. He realized a grave flaw in his business model. Any potential profit from selling IRCs in the U.S. would be offset by the expenses incurred in shipping the IRCs from Italy (or from any other country).

So what did he do? He decided to convert his business from legitimate to illegitimate.

The infamous Ponzi scheme

Ponzi thought that with his confidence and charm, he would be able to convince his investors that his business worked and was very profitable. He started to take money from investors, and rather than investing the money in buying IRCs, he kept some of it with him and distributed the rest of the money to earlier investors. This would not only increase his earlier investors’ confidence in him but also prompt them to reinvest their money with him, which he would then use to pay other investors.

.jpg)

Ponzi targeted people with little or no financial knowledge who wanted to get rich quick. He offered a 50% return in 45 days or a 100% return in 90 days. Soon Ponzi started getting loads of new investors, and The Boston Post did an article on him, calling him a “financial genius”.

Ponzi started lying to people, claiming that he had hundreds of agents globally buying IRCs in bulk for him. At the peak of his fraudulent scheme, he used to rake in $250,000 a day.

Ponzi finally started living the life he always yearned for.

Then came a man who smelled a rat: Clarence Barron. The Boston Post, which once hailed Ponzi as a financial genius, started suspecting his monumental rise. They hired Clarence Barron to start an investigation into his schemes.

Barron did some calculations and concluded that Ponzi would need to purchase 160 million IRCs to sustain his business. The only problem was that there were only 27,000 IRCs in circulation globally. The Boston Post published a front-page article exposing Ponzi but to no avail. Government officials were too enamored by Ponzi’s charm and confidence to take any action against him.

Get rich quick, get caught faster

At his peak, Ponzi had hired a publicist named William McMasters. Unlike Ponzi, though, McMasters was an honest man who, upon realizing Ponzi’s dishonest practices, gathered evidence from Ponzi’s records and went to the Boston Post. He wrote a Pulitzer Prize-winning exposé that laid bare Ponzi’s secrets. As a result, the Ponzi scheme crumbled, leading to multiple bankruptcies and thousands losing their life savings.

A slap on the wrist

Ponzi had to face the federal court, where he was put on trial for 86 different counts of fraud. He was potentially looking at a sentence of life imprisonment, but somehow he managed to strike a deal, pleading guilty to just one charge and receiving a lenient five-year sentence in federal prison.

Ponzi was released after three and a half years, but he demonstrated no remorse. He went to Florida and started working on a new scam immediately. But this time it failed even before it was launched.

Ponzi attempted to escape to Italy but was arrested in New Orleans. This time, he received a seven-year prison sentence. After serving for seven years, Ponzi came out as a broke man, devoid of the charm and confidence that once defined him. His wife, Rose, divorced him in 1937, and Ponzi spent his final years in poverty in Italy, reminiscing about the time when he had it all.

He died in 1949 in a charity hospital in Rio de Janeiro, Brazil, marking the conclusion of one of history’s most infamous swindlers.

Stay aware, stay safe

History has repeatedly uncovered swindlers who were, in some way, inspired by Ponzi. There are other different schemes to defraud people, such as the pyramid scheme, which is a deceptive investment model where participants earn profits primarily by recruiting new members. The structure resembles a pyramid, with existing members at the top recruiting new members who, in turn, recruit others. Each participant is required to make payments to those higher up in the hierarchy, and profits are derived from recruitment rather than the sale of actual products or services. The focus is on building a hierarchical network through direct recruitment efforts.

In 2023, India witnessed the highest number of pyramid schemes in the past five years. This study was conducted by Strategy India, a consultancy linked with the Indian Direct Selling Association (IDSA). The Economic Times published a scam alert list that included names such as Mission Green India, Jeevan Daan, Dhan Vriddhi, and Captcha Pay. But these schemes can be covered in another article. In the meantime, I would recommend that you all be cautious of these frauds and save your hard-earned money. Always remember that if it’s too good to be true, then you are most definitely getting ‘ponzied’.