John Pierpont Morgan: The man who shaped America’s banking industry - Part 1

By Aniket Gupta | 30 Oct 2023

A man always has two reasons for doing anything: a good reason and the real reason – J. P. Morgan

19th century America experienced a proliferation of individuals who craved wealth – and managed to acquire it. And, with it, they acquired power and influence.

One such individual was John Pierpont Morgan. He was a man who created the biggest financial entity in America, which survives to this date and is one of the most influential banking institutions in the world.

Morgan was the first man to own a billion-dollar company.

He dominated America’s most profitable industries. So great was his influence and power that, on many occasions, the US economy quite literally depended on his actions. Morgan was admired by many and hated by some.

A sickly child

Another rags-to-riches story it was not! John Pierpont Morgan was born into a wealthy Connecticut family on 17 April, 1837, son of Junius Spencer Morgan, a banker and a partner in Howe Mather & Co.

He had a troubled childhood because of rheumatic fever, which persisted through his youth. So, instead of going out to the playground, he spent much of his days at home studying the financial reports of different companies.

Morgan’s rheumatic fever incapacitated him at one point; so his father sent him to live in the Azores, an archipelago in the middle of the Atlantic Ocean off the Portuguese coast. The elder Morgan believed the warm climate and the sea air would help John recover.

John stayed on the island for about a year and then returned home to complete his education. His father wanted him to study in different countries so that he could learn more about the world. By the time John turned 19, he had studied in Boston, in America, in Switzerland and in Germany; and was ready to join the workforce.

John’s father, Junius, was then working as a junior partner in a London-based firm called George Peabody & Co. And John was hired by a Wall Street banking firm that handled Peabody’s American ventures.

The elder Morgan feared that his son was too rash and hot-tempered to ever become a successful financier; that he needed to learn restraint and take responsibility. In 1859, John took a big risk and purchased an entire shipment of Brazilian coffee with company money. Even though he sold the whole batch and made a modest profit, he had taken a big risk. And that rubbed his seniors the wrong way, including his father.

John started to feel that he would never realize his potential in his current workplace; so, in 1861, he left the firm to open his own financial business. His firm continued to act as an agent for his father’s bank in England.

Then tragedy struck when he was 24. John lost his wife, Amelia Sturges, to tuberculosis.

War meant profits!

In the 1860s America was in a huge mess. The Civil War had broken out in 1861; and businesses faced a sea of uncertainties. John paid $300, then a hefty sum, to be exempted from enlisting and to have someone else substitute for him.

Not enlisting was not the same thing as not being involved with the war. The young Morgan found a financial angle to the war.

He financed a consortium that purchased 5,000 surplus Hall carbine rifles at $3.50 each from the government. They had been considered too old to use. After making some minor adjustments to the rifles, the consortium immediately sold the same rifles back to the government for $22 each. It meant a 528 per cent mark-up over the purchase price, and turned out to be a very lucrative deal, though such wartime profiteering was looked upon with favor either by the government or by the public.

The railway magnate

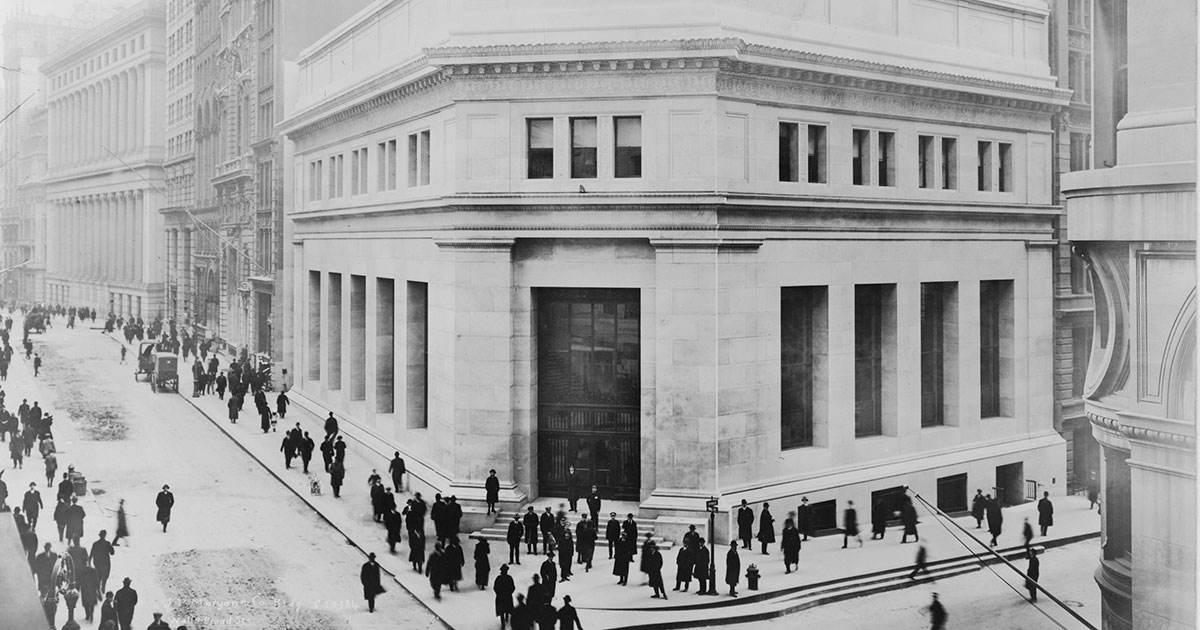

In 1871 Morgan teamed up with a well-known financier, Anthony Drexel to form Drexel, Morgan & Co., a private banking house, which was later renamed as JP Morgan & Co. Morgan would be managing this firm for the rest of his life. This bank went on to become the modern banking titan we know today as JPMorgan Chase & Co.

When John started his career, his main job was to connect wealthy investors and visionaries and earn a commission. But as he started building his own personal wealth, he started to finance big projects. Among these were American railroad projects.

At the time, most of the other big industries were dominated by one single magnate. Andrew Carnegie dominated steel and John D. Rockefeller dominated oil; but the railroads had not been monopolized.

There were a large number of railroad companies competing with one other, providing similar routes and indulging in price cutting to win over more customers.

Morgan saw in this situation a golden opportunity to enhance his profits. The idea was simple, if crude. If the railroad companies could be consolidated it would end the cut-throat competition between them, and profits would rise. Railroad companies started to merge and then set whatever prices they wanted as they owned all the nearby railroads.

Morgan financed multiple railroad companies. He also started buying under-financed companies, streamlining their management, improving operational efficiencies, and merging smaller companies into one dominant player that could crush the remaining competitors. He would then take over those competitors as well.

He became so well-known for this tactic that it was named after him – as ‘morganization’.

Not content with acquiring railroad companies, Morgan played a key role in their management. He brought much greater stability to the industry. The stability attracted more investments, especially from parts of Europe. And of course, John raked in the profits.

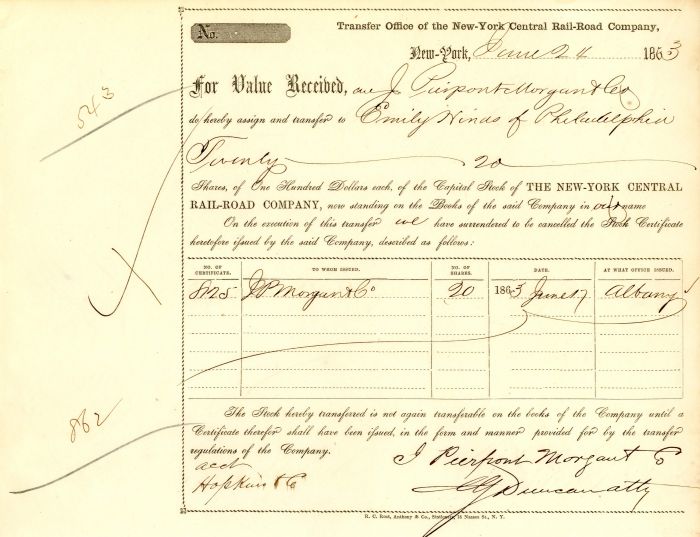

Morgan purchased 250,000 shares of stock from William Vanderbilt in one of the biggest railways in the country, the New York Central Railroad. Soon, Morgan owned one-third of all railroads in the United States. This was an era when 60% of America’s stock market capitalization consisted of railroad companies.

J.P. Morgan had now turned from a wealthy financier to a man who was single-handedly shaping the railroad industry in America. But his ambition grew; and he wanted more.

A worthy adversary

In 1901, Morgan finally met his match and a fierce adversary: President Theodore Roosevelt.

Morgan had just consolidated his Northern Pacific Railroad with two other railways in the region and created a massive new holding company called the Northern Securities Corporation. He was able to get away with these kinds of monopolistic practices due to his close relationship with the previous president, William McKinley.

But on 14 September 1901 McKinley was assassinated in Buffalo, New York, and Roosevelt became president. The new president took a very different view about what Morgan was doing. He ordered the justice department to file a suit against the company for violating the Sherman Antitrust Act of 1890.

Morgan challenged the action in court, but the company ended up being split up.

Did he sink into despair? No, he saw it was as a mere small setback. He was already planning for bigger things.

The next part of this story will cover Morgan’s deal with another business magnate, Andrew Carnegie, his attempt to make the world’s first billion-dollar company, and the legacy he left behind for future banking professionals and entrepreneurs.